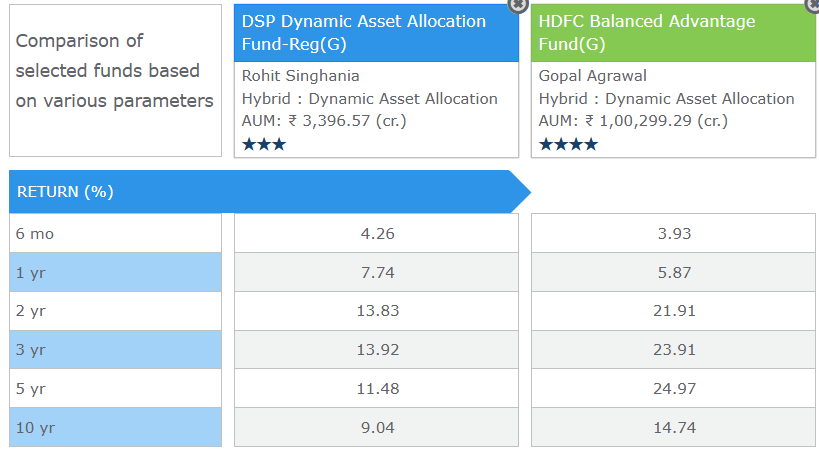

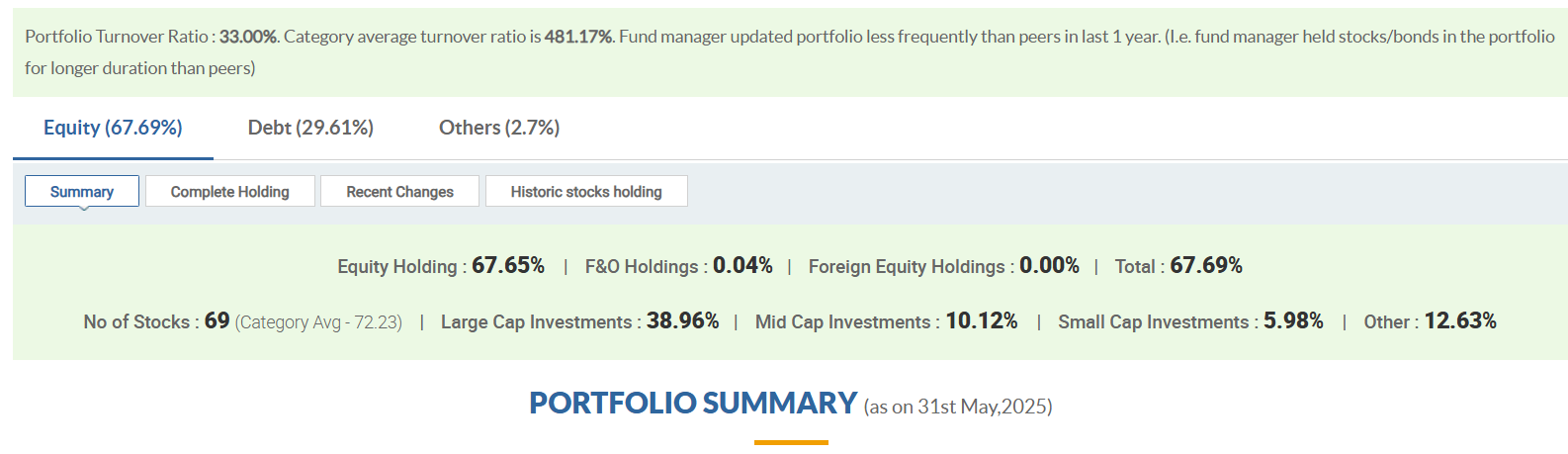

In this Category, Moneycontrol etc do not give the whole picture of the funds, Most balanced advantage funds have atleast some portion which is arbitrage( risk less 6-7%). HDFC balance advantage fund has 67% equity out of which 7% is arbitrage. So 60% equity exposure. 3 year return - 23.25% cagr

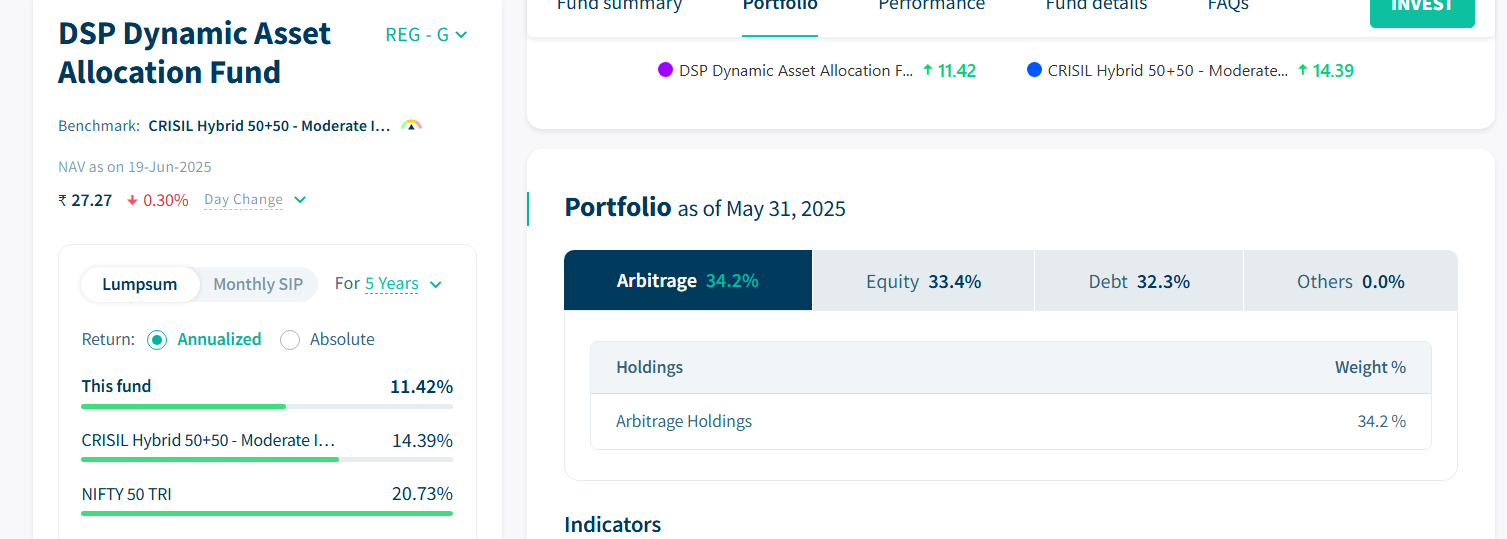

While a fund like dsp dynamic asset allocation is 65% equity but 35% is arbitrage, so equity market exposure is actually 30%. 3 year return - 15.23%

same balance advatange category - two totally different products. One has much higher equity exposure.

This is from moneycontrol , inaccurate , DSP mutal funds equity 67%

If you look at the DSP mf website, the portfolio shows , the arbitrage part