If you are someone whose idea of a fun Saturday afternoon is not “going through annual reports & quarterly filings to find a company that can triple its earnings in the next five years”

If you would rather read the Times of India than Economic Times

If you have not already read the “Intelligent Investor” and a dozen other books like it and have no plans of reading the “Intelligent Investor” and a dozen other book like it

If you do not quote Warren Buffet and Charlie Munger to impress(good, people were not getting impressed)

Then this note is for you

I have some good and bad news for you, in optimistic fashion I would like to start of with the good news first, after all what is the point of being pessimistic in life? Close your eyes and take a deep breath, your DNA did not stand the test of a billion years by being pessimistic. “Cautiously optimistic” is what we will be going for.

The good news: You can still make a very good return in your investing lifetime. Be it in real estate, equity, or Debt markets. Preferably a combination of all three. In my working at the biggest family offices, treasury roles in India people understand this concept fully. Asset allocation is a more of a mindset than you would like to believe, not requiring the same level of deep industry/business knowledge as an experienced equity investor.

The bad news: There’s clearly an issue with how well people believe they can drive. When asked to rate their driving ability, the majority of people—up to 80% in some studies—claim that they are above-average drivers. They think they are skilled and proficient in a way that the drivers around them simply lack.

But, logically, the majority of drivers can’t be above average. The problem is far worse in investing than in driving. Forget 80%, almost all think they are better investors than the average investor. Somehow, we feel we have the emotional balance to invest large sums of money in a cold and calculated manner, the knowledge to understand different opportunities when they arise and most importantly the wisdom to know when we do not. If it were not for our delusions, are we even human?

I find role play particularly enjoyable in some other areas of my life. Lets do it here as well, you are the chief investing officer at a family office (A family office is a group of employees that handles investment management for a wealthy family, something close to 500 crores of investable wealth would be a good number to start such an office, below that salaries will be too big of an expense in ratio to the assets at hand). The role is not often limited to investments, but covers all areas around investments- Estate planning, Tax management etc.

So I would like you to also think, feel and act like a man responsible for half a billion dollars(Rs. 4,300 crore) this one time. You are a star asset allocator with twenty-three years of experience. You charge money not to work but to think and act. To nudge the course of action in the right direction, a watchful protector. This person is you now!

Here we begin:

Situation 1: The bigger picture

Anju sold off her Saas business to Microsoft a few years ago for Rs 3600 crore, making her an instant know name in M&A and wealth management circles. Her earlier investment advisor with the help of a wealth management team from a large bank acting as a consultant managed the money till now. The returns have not been bad for her, equity markets were rewarding and most of it was locked in earlier in fixed maturity plans. But over the last few years Anju has grown a lot in financial knowledge given the size of her investment account she is constantly contacted by fund managers, chief investment officers and all sales head in the industry. She now wants to hire you, an experienced treasury manager at a listed company in India to make a family office in her name. But why now ? We will discuss this in detail another time, now is not the time. As these FMP mature, large amount of the initial money will be available again to reinvest.

Current asset allocation is :

Equity: 4%

Fixed Income: 85%

Commodities: 2%

Real estate: 9% (Not in family office’s scope of work for now)

In your joining meeting, she has asked you to target a 14% return on the half a billion now under your stewardship. This should be only a percentage point above long term large cap equity category return. You start of the conversation agreeing with her, you always start of the conversation agreeing with people and then make a few counter points in the conversation to feel them out, this is not your first rodeo, you in earlier corporate avtars have spoken the proverbial truth to power. You suggest a 10% annual target return for the family office, this would handsomely beat inflation and add some to the kitty each year. Your rationale for lowering the target return is

- Already a lot of risk, hard work & good fortune went into collecting this giant pile of cash, why risk it again ?

- To make a 14% return, you will have to keep equity allocation at 65-70%, assuming the return of the past are repeated. In case of a 30% market fall(which can happen anytime), the notional loss will be 900 crore. Not many people has the stomach for this kind of loss, even paper loss.

- In the scenario of a 65% equity allocation, once equities fall 30%, will you add more when your initial allocation to equities was 65%, will you really want to take it up to 90%? Why risk it all ?

- Instead you suggest a 35% equity allocation target at current market levels, since markets have fallen off the high highs of late 2024, and valuations are not at an all time high, neither it is a bargain hunters dream out there in mid 2025

- A 35% equity allocation will give you substantial wiggle room in case of further softening of values, you could take up the allocation to 50%-55%. Increasing allocation by 20% to equities in covid crash(4300*.20= 860 crore), would have doubled in only months.

Reality:

Why would you assume that equities will keep giving positive returns over a 5-10 period horizon? Is it because you believe India will keep growing at 6-7%? Countries like China have grown faster than that for a decade, without any stock market return. Is it because you believe that financialization is just starting out in India, the SIP flow will not let market fall, as Nirmala Sitaram stated in parliament “DII can absorb the shock of FII selling”? May I remind you, the equity market is a marketplace, like Amazon for the buying and selling of businesses. One party sells his share in a business and the other patry buys it at the agreed amount(LTP). That money goes into the bank account of the seller and at the buyer becomes the shareholder of the business. If you end up overpaying for the growth, you will not make any money on your initial investment. You must be very value oriented in your equity buying. Imagine buying a house for 75 lacs with a rent of 5 lacs per year in a new area of your city. Now there is news that new airport is coming, the market is now pricing your house at 2 crore, rent is now 8 lacs. Now an Olympics stadium is also coming up, the house is now 4 crore, rent 12 lacs. Anyone buying at this steep valuation, is paying for the future growth , for him to make money, these promises need to become a reality and then some. Else because of a delay in airport construction by 5 years and he would still be sitting at a 4 crore valuation. By this theory you will need someone to pay an even higher rate for the same share of the business every time. Greater fool theory

In FY24 given the high valuations, FII (forgien institute investors) + promoters were selling and DII (retail) was buying.

Promoter selling over past 5 years

Year Total Selling (Cr)

2024 1.49 Lakh

2023 1.26 Lakh

2022 62,828

2021 86,969

2020 1.04 Lakh

“In bear markets stocks return to their rightful owners” Jp Morgan

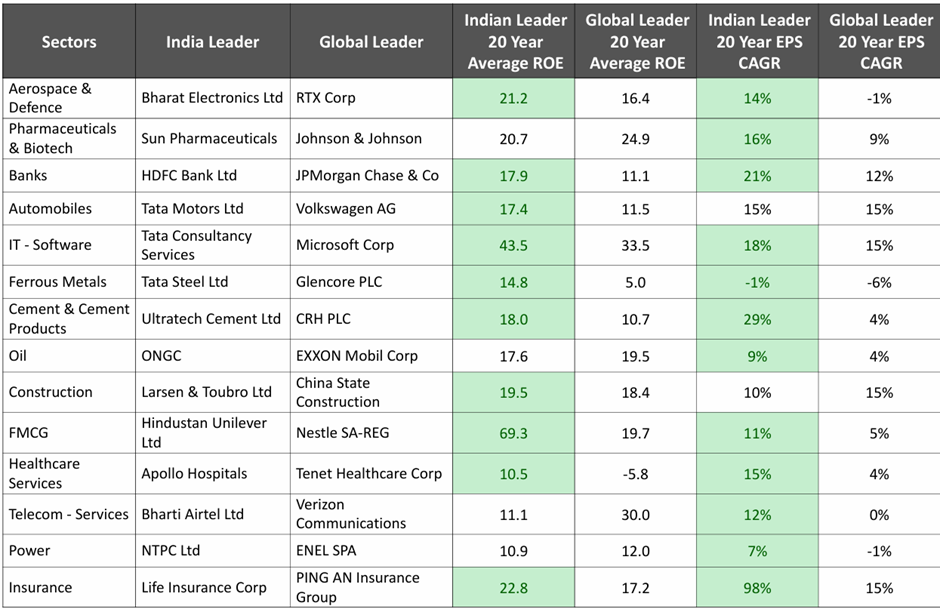

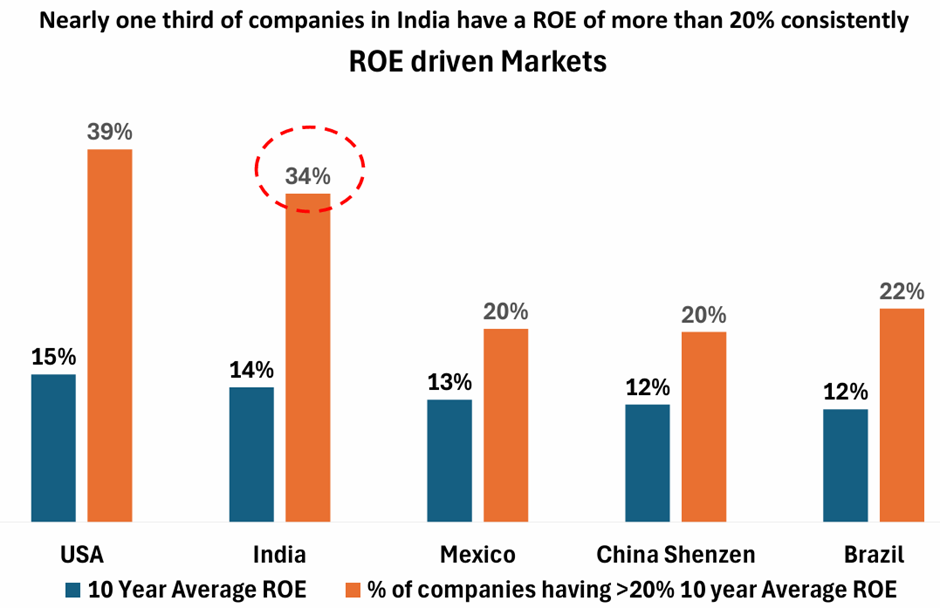

A high ROE (return on equity) is a much better predictor of long term stock returns. India ranks second only to the U.S. in the number of firms consistently achieving a ROE of over 20% for more than a decade. This strong performance in ROE is the true engine behind India's superior stock market results

Source: Netra, DSP mutual funds

Source: Netra, DSP mutual funds

Only a few counties in the world have given a long term equity return(10-15 years) in double digits. India and USA. High long term equity return is the exception, not the norm. One cannot simply assume the past will keep repeating itself.

You need a high return on initial capital (ROE) that can be deployed (profit growth) year over year and need buy at a moderate valuation to make a great return in equities. The above scenario seems likely in India’s case but is not a guarantee in any way. It is a risk we will take and if we are right a return we shall receive.

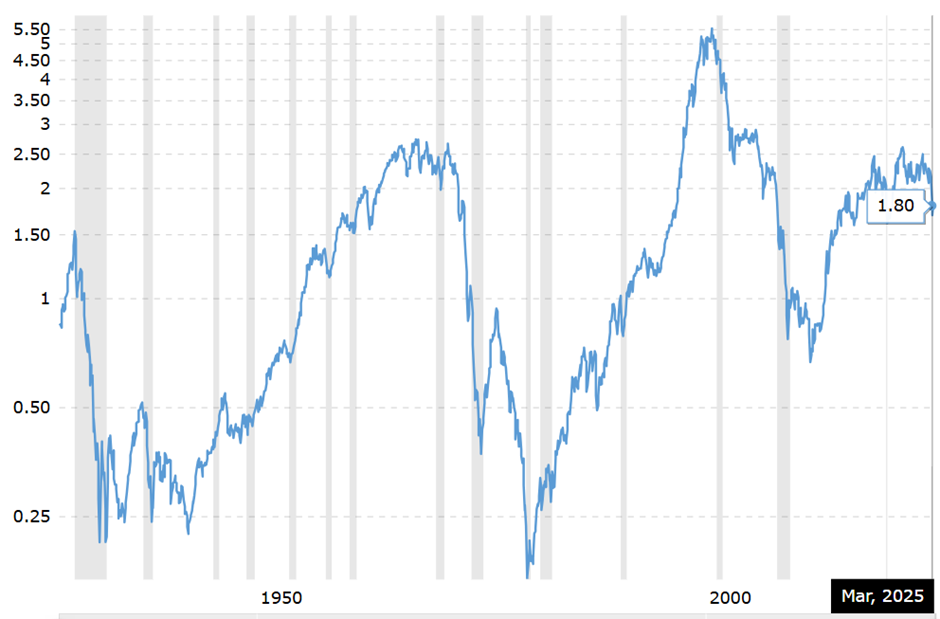

Plus some part of the returns can be attributed to the cheap & endless supply of paper currency by central banks. One look at the gold/USA equity chart below shows how the equity indexes only keep breaking new records in paper currency. If you were being paid in a fixed amount of gold, nothing would be really getting out of reach, would it ?

Chart- Ratio of S&P500 to gold

The number tells you how many ounces of gold it would take to buy the S&P 500. Dot com bubble (2000) was the mother of all equity bubbles. At its peak you needed 5.5 ounces of gold to buy one unit of S&P500 ETF

A 10% return target, comfortably beating inflation (4-6% most years), adding to the family wealth and most importantly not risking it all. Targeting a 10% return on a 4600 crore portfolio is not simply finding 10% yielding NBFC bonds and holding them till maturity (the concentration risk & counter party risk will be too much). We will carefully layer from the most volatile microcap equities to the safest GOI short term papers as per our risk goals. We will think on this next week, time to go home to the wife and kid. Robin Williams-Medicine, law, business, engineering, these are noble pursuits and necessary to sustain life. But poetry, beauty, romance, love, these are what we stay alive for .